Better prepare so you can enjoy the lifestyle you envision.

We’ll examine your finances in a holistic manner and tailor a comprehensive financial plan to your unique situation.

See if our expertise matches with your needs.

Feel more confident you’ll reach your short and long-term goals.

It’s not uncommon for financial decisions to be made in isolation. For example, you may enlist the help of a financial advisor for your investments, a CPA firm for your taxes, and an agent for your insurance needs. These parties perhaps all offer relevant advice, which is perfectly fine.

However, at some point in your life, you’ll need to partner with someone who can evaluate all aspects of your finances, together—identifying how they affect one another and how they can effectively cooperate to put you in the best position to reach your goals.

Financial planning serves this very purpose.

Your financial advisor will adopt a thorough, holistic view of your finances to identify what’s working—and what’s not—before ultimately delivering a roadmap you can use to move forward. He or she will then update your plan as you encounter different life events or reach various milestones.

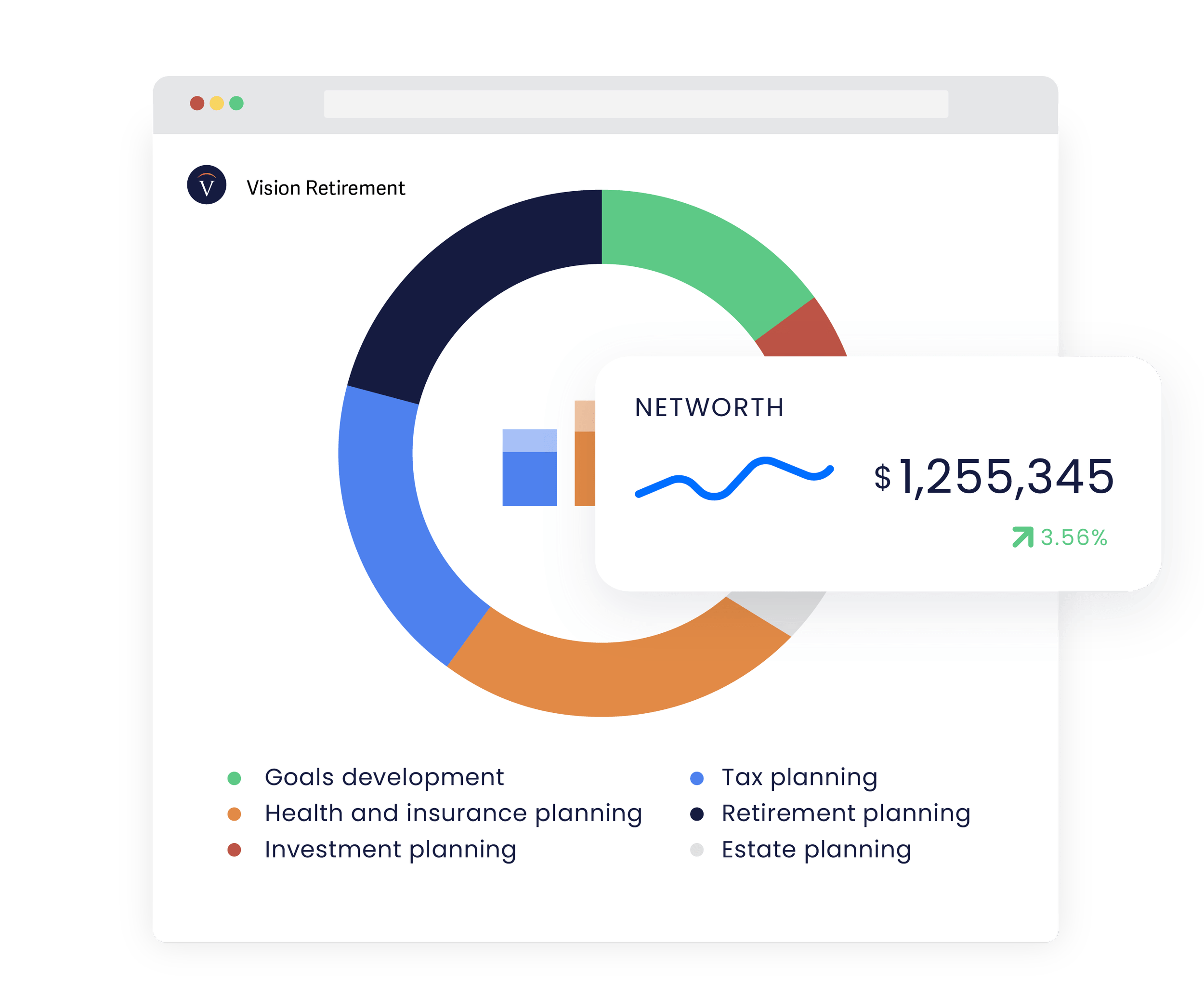

Areas our financial planning services often cover include:

Goals Development

We'll work with you to pinpoint both your short- and long-term goals.

Investment Planning

We’ll help balance risk and return so your investment portfolio gives you the best chance to achieve your goals.

Estate Planning

We’ll maximize the value and minimize the cost of your estate to help ensure your assets are smoothly transferred to heirs.

Cash Flow Planning

By forecasting your current and projected cash flow, we’ll develop a plan of action moving forward so you know exactly where you stand.

Tax Planning

We’ll make sure your retirement accounts are as tax efficient as possible so you don’t pay the government more than your fair share.

Health & Insurance Planning

From navigating the complexities of Medicare to evaluating your individual insurance needs, we can help make sure you’re protected.

Retirement Planning

Evaluating how to maximize Social Security benefits, identifying when you can retire, and boosting the chance you won’t outlive your money during retirement are just some of the questions we’ll answer in this respect.

See if our expertise matches with your needs.

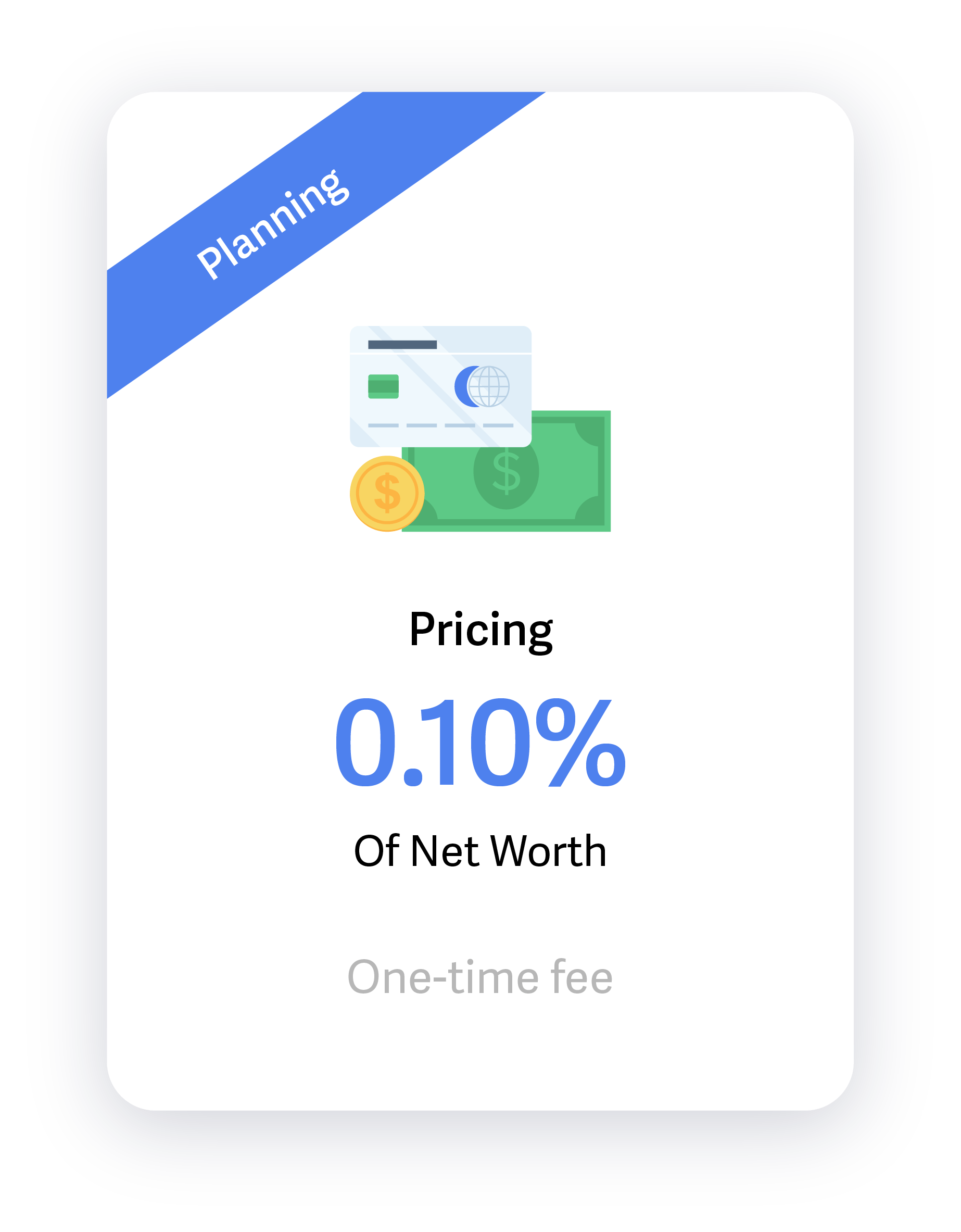

Pricing and Other Considerations

Financial planning summons a one-time fee based on the complexity of your situation. Your investment for this service is calculated at .10% of your net worth (e.g., if your net worth is $5 million, your cost is $5,000). Please note a minimum fee of $2,500 applies, and you’ll receive a 25% discount on subsequent plan updates to address any life-changing events.

See if our expertise matches with your needs.

As Seen In

FAQs

-

Financial planning, understanding where you are today and developing a roadmap to get where you want to be, goes beyond investments to adopt a holistic view of all your finances. Importantly, financial planning is not a rigid process but a dynamic one that constantly evolves as you experience various life-changing events (e.g., reducing/stopping work, having children or grandchildren, moving to a new city, or managing the death of a loved one).

-

The first step is outlining both short- and long-term goals and reviewing all your financials; your financial advisor will use this information to present and discuss subsequent strategies/recommendations and then deliver and review a personalized roadmap you can utilize to stay on track.

-

Financial planning is essential as it can give you better control over your future, helping to establish annual savings goals to meet your retirement lifestyle objectives (for example). According to several studies, a written financial plan can also make you feel more confident you’ll achieve your goals and steer you toward better financial habits (e.g., establishing an emergency fund, minimizing debt, and regularly rebalancing your investment portfolio).

Start simplifying

your journey and speak to a financial advisor today.

See if our expertise matches with your needs.